A Company Normal Selling Price for Its Product

Calculate the value of this companys inventory at the lower of cost or market. The retail company must set the selling price of its womens one-piece swimsuits at 3750 to generate its desired revenue and cover the cost-per-item expenses it incurs to supply its products.

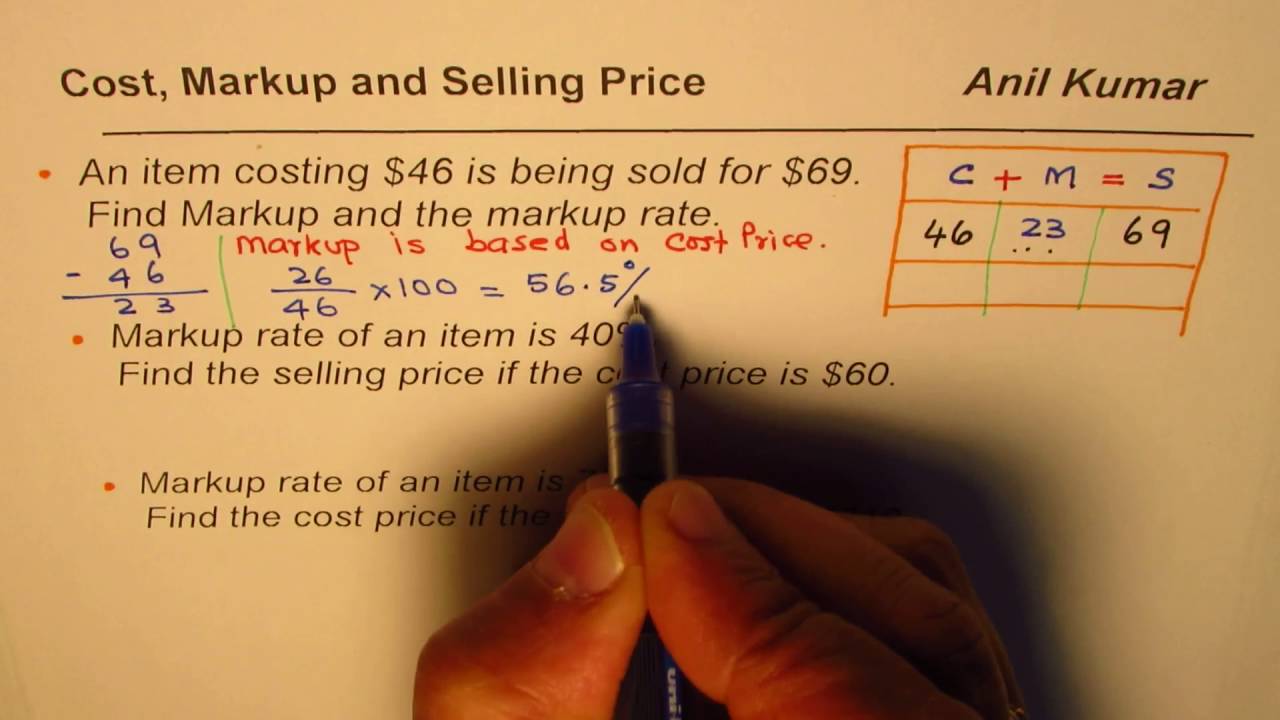

How To Calculate Markup Selling Price And Markup Rate Youtube

This companys current FIFO inventory consists of 270 units purchased at 23 per unit.

. Net realizable value has fallen to 15 per unit. Number of products sold. Replacement cost has fallen to 16 per unit.

By dividing 450 by 25 this brings the figure down to 1 of the selling price 018. So regardless of if you sell an item with 10 SKU variants or 100 you calculate selling price ASP by looking at the total revenue earned from those sales and dividing the amount by the total number of units sold. This companys current inventory consists of 180 units purchased at 18 per unit.

Average Selling Price 200. However due to market competition the selling price has fallen to 22 per unit. This company s current inventory consists of 230 units purchased at 19 per unit.

It can help a business set the selling price according to the percentage of profit it expects. However due to market competition the selling price had fallen to 25 per unit. A company normal selling prices for its product is 30 per unit.

This is an example where the actual selling price and the average selling price dont match exactly. A companys normal selling price for its product is 23 per unit. A companys normal selling price for its product is 22 per unit.

To calculate the selling price based on this information. The business leaders want to know the average selling price of Hot Pies bread machines. Its selling price will have to be 125.

A company normally sells its product for 20 per unit. Accounting questions and answers. Margin is Gross Profit Selling price 286 286.

Selling price cost profit margin 25 5 x 25 25 1250 3750. Your selling price would be computed as. The selling price per unit includes the cost of creating the product as well as the profit earned from the sale of the item.

This companys current FIFO inventory consists of 160 units purchased at 20 per unit. By then multiplying by 100 it brings the figure up to 100 the selling price 1800. For example the gross profit formula is selling price cost price gross profit.

For product-driven companies like Apple calculations for average selling price provide pivotal information about its financial performance. If a jacket had a variable cost per unit of 14 and a contribution margin per unit of 7 the jacket would have a selling price per unit of 21. Calculate the value of this companys inventory at the lower of cost or market.

However due to market competition the selling price has fallen to 19 per unit. Using the example above lets say we want the selling price to give us a 40 margin. The company calculates the selling price like this.

This companys current FIFO inventory consists of 170 units purchased at 19 per unit. However due to market competition the selling price has fallen to 17 per unit. Normal sell price 20 per unitprofit margi of25 mean profit is 5 per unitselling price has come down to 15 per unitcurrent inventory consists200 units purchased at cost 16 per unittotal cost of current inventory consists of200 units 200 16 3200Value of inventory at the current market pricecost 200 15 3000Please correct me if I did anything wrong or.

A companys normal selling price for its product is 23 per unit. However due to market competition the selling price has fallen to 17 per unit. However due to market competition the selling price has fallen to 18 per unit.

On the other hand a very low selling price can affect the companys. This companys current inventory consists of 200 units purchased at 16 per unit. A company s normal selling price for its product is 23 per unit.

See the calculation below. A companys normal selling price for its product is 24 per unit. However due to market competition the selling price has fallen to 18 per unit.

View the full answer. Replacement cost has fallen to 15 per unit. Any product with a high selling price cannot attract many buyers because consumers do not consider it a good value for money.

140 X 140 196. However due to market competition the selling price has fallen to 19 per unit. The average selling price or ASP for short is the price you charge your clients for your goods or service.

Accounting questions and answers. 45025 100 1800. Here are two examples of the selling price per unit.

A companys normal selling price for its product is 27 per unit. Selling price per unit examples. Net realizable value has fallen to 20 per unit.

A companys normal selling price for its product is 22 per unit. This companys current inventory consists of 100 units purchased at 26 per unit. Replacement cost has now fallen to 13 per unit.

However the selling price has fallen to 15 per unit. Fixed price trading is a good example of this. A companys normal selling price for its product is 24 per unit.

In the example above gross profit is 196 140 56. Replacement cost has fallen to 17 per unit. Heres the formula for average selling price in action.

However due to market competition the selling price has fallen to 18 per unit. This companys current inventory consists of 160 units purchased at 20 per unit. This companys current FIFO inventory consists of 220 units purchased at 18 per unit.

Selling Price Cost Price Gross Profit SP 10 20 of. Selling price is a very sensitive issue because the sale of a product is very dependent on it. Lets suppose a product costs the company 10 and it wants to make a 20 profit.

Accounting questions and answers.

What Is A Unit Selling Price Bdc Ca

No comments for "A Company Normal Selling Price for Its Product"

Post a Comment